What to negotiate in Public Private Partnerships?

Post by Chandrima Mukhopadhyay (CEPT University Ahmedabad).

Public Private Partnership is an inter-disciplinary subject in nature. However, it is considered as a highly specialised area, and a large audience from Urban Planning background remain unaware about the subject. In this short piece, I intend to reflect upon what PPP (in infrastructure) is (specially in emerging economies context, based on experience in India and literature in Latin America), how the subject is interdisciplinary, and finally, from a policy perspective what is so crucial and to be negotiated amongst public and private sector partners. This write up is based on my experience of teaching the subject to multi-disciplinary groups. I believe the subject is more generic, and urban scholars and professionals must pick up an interest in understanding what is the deal about involving private sector in infrastructure development, mega projects, and now in the process of urbanisation. The underlying logic would somehow remain the same.

Figure 1. Interdisciplinary nature of PPPs

Public Private Partnerships (PPP) is an overtly familiar terminology in the development sector, a mandatory subject for future generation Urban Planners specially in the emerging economies, however, the understanding of the vocabulary is limited. With varying understanding of what PPPs are, the subject, at times, is also considered a highly specialised area. In this blog, I outline what PPPs in infrastructure are, and argue why the subject is more generic than it is thought. The debate on private sector intervention remains political.

PPP is loosely understood as an alternative tool of infrastructure delivery with private sector participation. Private sector intervention, both in infrastructure and urban development, must interests Urban Planners, as their intervention influences not only the process of urban development but the output delivered through the process too. In infrastructure sector, there are degree and forms of private sector involvement: PPP being used as a generic term. PPPs ideally should be adopted on the ground of delivering better value for money (VFM), that is, delivering better infrastructure at a lower public cost. This is a policy level question, however, hardly the deciding factor. It would be interesting to extend the same logic of VFM while making decision on to what extent private sector should regulate such models.

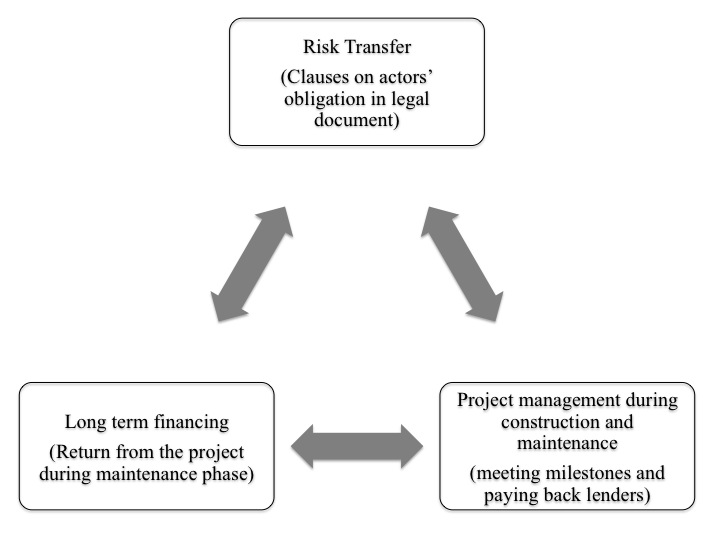

Whereas various academic postgraduate programs (in India), i.e., Public Policy, Technology, and Urban Planning, include course on Public Private Partnership, students’ understanding of the subject (based on undergraduate degree) and their interest (based on future potential job and required skill) largely vary. Technology students are more interested in nitty gritty of the model; Public Policy students (also from African continent) question the sustenance of the model in the long run. However, such varying interests are not exclusive; in fact, they complement each other. This is to say, the very basic understanding of PPP is truly interdisciplinary. The main components of PPP: risk transfer (which is transformed into clauses in legal contract), long-term financing (which makes a project financially viable for private sector), and efficient project management (tied with legal contract and financing) must be understood in combination and not in isolation. It shows how technical, economic, financial and political decisions are intertwined in the model. Figure 1 above represents a schematic diagram to explain the same.

For instance, risk transfer is highly complex in nature: first, the logic behind transferring risk is that the risk should be transferred to the actor best able to manage it; however, it is hardly ideologically implemented in reality; risk is transferred to the less powerful actor, because it is about cost transfer. Second, risk is intangible, and it is transformed into monetary value for decision-making based on many assumptions including varying perception of risk (that varies across in terms of probability of the risk occurring and implication of the risk) by different stakeholders. Third, risks are transformed into clauses in the legal agreement in terms of partner’s obligation for timely delivery and related penalties; legal clauses are open to interpretation. Moreover, risk distribution, and legal clauses on timely delivery are tied up with the private sectors’ financial model. This makes the overall risk transfer process complex and interesting.

The point of negotiation

In fact, the component of risk transfer is one of the main decision-making factors for partnership formation. To a great extent, this contributes towards the understanding of degree of public sector regulation. Private sector is known for its entrepreneurship and would be willing to take higher risk in the hope of higher return. This makes certain infrastructure sectors attractive for private sector. From public sector’s side, it is in advantage of them that private sector is willing to invest. In reality, public sector also intends to transfer higher risk towards the private sector to reduce public cost. Now, even though initially higher risk means higher return, public sector should not ideally transfer risk to private sector beyond a point, as this would also imply that they are transferring all return from public infrastructure to private sector. This should be ideally the point of negotiation between public and private sector partners. The decision-making is crucial as on one hand, public sector would depend on private sector for generating higher revenue through infrastructure (for instance, the so-called “world-class” infrastructure could not have been delivered without private sector), on the other, public sector should not transfer all the revenue generated from public infrastructure to private sector actors. Unfortunately, little attention is paid on what share of revenue is retained back, especially in a time when public sector faces financial resource scarcity.

Transparency and Accountability

Transparency is a contested issue in PPP. Private sector has legitimate demand for confidentiality for their business secret. Close reading of the framework of accountability shows that PPP projects are not subject to the test of public scrutiny during project procurement (construction and maintenance) that would have not been waived in case of public sector procurement model. The dilemma is: on one hand, transparency has become a policy booster for good governance, and there is an effort on improving transparency; on the other, public infrastructure sectors are increasingly being privatized, and private sector actors are bound to be confidential to public. Transparency in private sector intervention model is a complex and extremely interesting.You can read more about my work on transparency in PPP here.

Misconceptions about PPP

Here are some misconceptions about PPP. First: PPP is a mere project financing mechanism; it is not just about using private money, it’s also about technological and institutional innovation. PPPs generated many new professions and roles for engineers that did not exist before. Second: PPPs are inexpensive. PPPs are mostly expensive, but with little cost to public (temporarily). Third: PPP model is not accountable. PPP evolved with improved framework of accountability over public sector procurement model but with limited transparency. Accountability is questioned when legal clauses are not strictly followed in practice. Fourth: transparency in PPP is a management issue. PPP offers a framework of accountability considering the whole project life cycle. Transparency is just one component of accountability. And it is restricted in project construction and maintenance phase.

The way forward

Finally, PPPs are unpopular for imposing ordinate-subordinate, or client-consultant relation, which develops conflict amongst partners, rather than cooperation, which would deliver better outcome. As a way forward for PPPs, emerging economies like India, Latin American countries and South Africa show promising examples in terms of innovation in various other sectors. Such new generation of PPPs are not just about private money, they bring specialized skill and innovation, and such models acquire public acceptance on the ground of their contribution towards causes like sustainability and combating poverty and corruption. Public acceptance is crucial to the sustenance of the model.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.

Comments